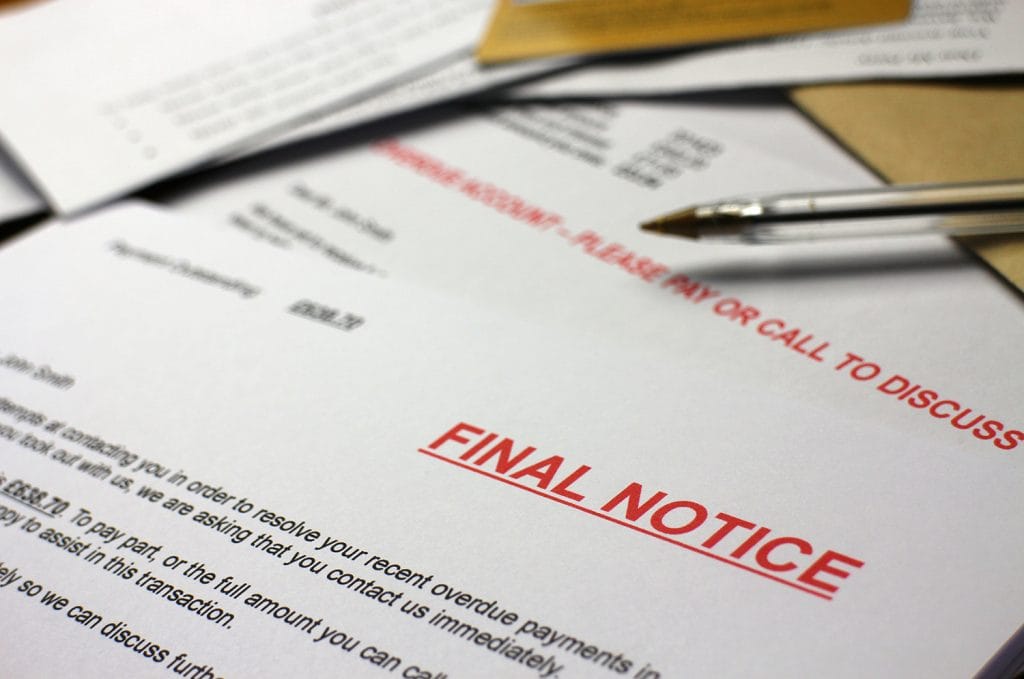

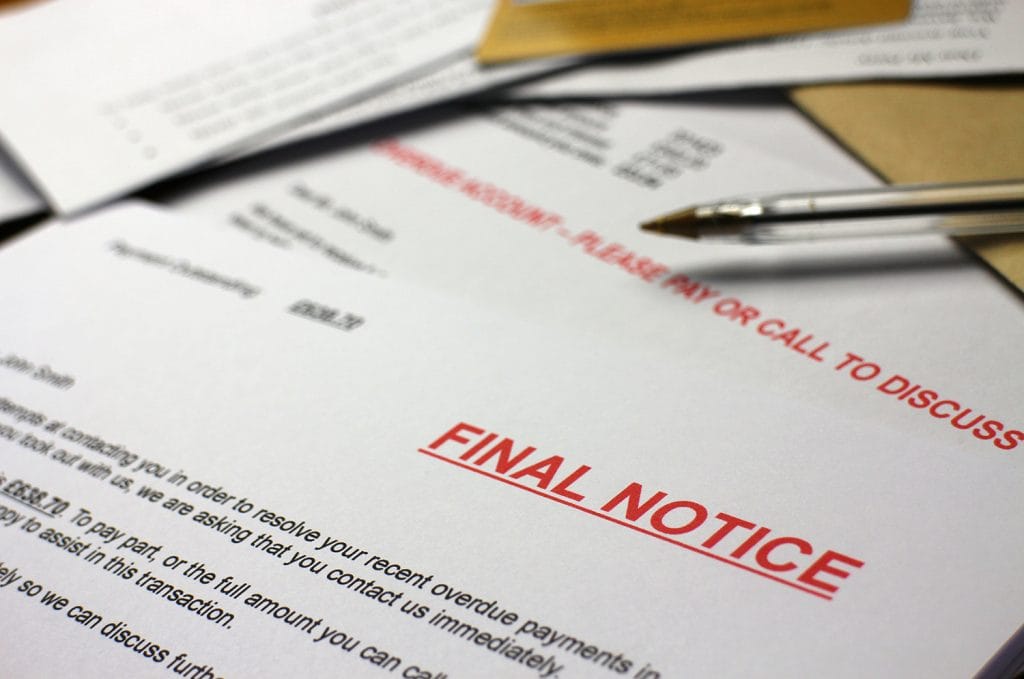

Phantom Debt Scams: What to Do If a Collector Calls You

Scammers are pretending to be debt collectors to pressure you into paying money you don’t owe. Learn how this scam works and how to protect yourself.

Blog

Get the latest news on South Bay Credit Union’s community events and practical financial advice to help you live better.

Blog

Get the latest news on South Bay Credit Union’s community events and practical financial advice to help you live better.

Scammers are pretending to be debt collectors to pressure you into paying money you don’t owe. Learn how this scam works and how to protect yourself.

The savings bucket method helps you organize your goals into separate savings accounts, making saving clearer, easier, and more rewarding.

Many employers now offer financial wellness and lifestyle benefits. Are you taking advantage of all you can get?

Don’t get duped by fake shops on social media! Learn how to spot scams, protect your money, and shop safely online.

Looking for some extra income? A side hustle can give your finances a major boost. Here’s what you should know.

Retirement is one of the major financial milestones that everyone should carefully plan for in their lifetime. With a 401(k), it’s up to you to make decisions regarding how to invest your money to maximize earnings.

Learn how to be a smart spender by understanding needs vs. wants, creating a budget, avoiding impulse buys, and making the most of your money from an early age.

Learn the best places to keep your emergency fund safe, accessible, and earning interest—plus what to avoid to protect your financial safety net.

Discover how quality sleep can sharpen your focus, boost productivity, improve decision-making, and even enhance your financial success. Rest well to achieve more.

College tuition rates and living expenses are steadily climbing. Understanding all expenses you’ll face can help you proactively create a sound financial plan.

Discover the risks of using public Wi-Fi while traveling and learn essential tips to protect your data.

Updating old features, increasing the square footage, and improving functionality can boost your home’s appraised value.

Understanding how to manage money wisely, from budgeting for daily expenses to setting aside funds for long-term goals, can be a game-changer.

Introduce kids to the difference between good debt and bad debt, how credit cards work, and why building good credit is important.

With the right preparation, you will have a relaxing trip and not come home to any financial disasters.

Staying vigilant and conducting your transaction quickly can be key to identifying and avoiding suspicious activity.

Discover budget-friendly home improvement projects that can transform your space and boost your home’s value.

Don’t blow your tax refund! Here are 6 ideas to help you think before you spend.

Learn how a money market account can help you reach your savings goals.

Copied to clipboard!